-

SmartPortal Upgrade

-

Joining SmartWork

-

Digital ID & Right to Work Check

-

Contracts & Compliance

-

Getting Paid

-

Claiming Expenses

-

Statutory Benefits

-

Workplace Pension

-

Private Pension / SIPP

- Private Pension/SIPP Scheme Contributions Explained

- Setting Up Your Private Pension/SIPP Scheme Pension Payments

- How SmartWork Calculates Your Private Pension (SIPP) Deductions

- Changing Your SIPP Salary Sacrifice Deduction Amount

- The ii SIPP for SmartWork Contractors

- Private pension FAQs

- Pension Guide for Contractors

-

Handbooks

-

Forms & Downloads

-

Policies and Statements

New SmartPortal FAQs

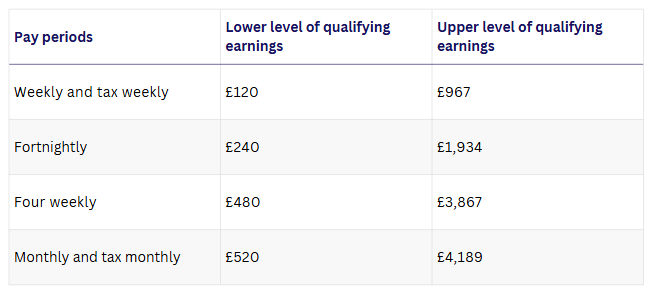

Please start using the new portal as soon as you receive your login details on 23 June. We have created a guide on how to get started with submitting your timesheet, which you can visit by clicking here. We will notify you by email with your new login details and password on the day the system goes live, which is planned for 23 June 2025. Please refer to our payslip guide, where we introduce the new payslip look. This will not change; payments will continue to be paid in the afternoon between 3:30 pm and close of business. No, you only need to submit timesheets to SmartWork if your agency requires an invoice. We will send you an SMS notification of payment. All payslips will be available on the portal, and we also offer an optional service where the payslip can be securely emailed to you each week. You will continue to have access to the old SmartPortal to refer to previous assignment information and payslips. The new system will only have current assignment and payroll data. SmartWork will keep hold of all historical payroll data for up to 7 years, as this is required. You will continue to have access to the old SmartPortal to refer to previous assignment information and payslips. The new system will only have current assignment and payroll data. Please visit our step-by-step guide in the knowledge base for instructions on how to do this. Alternatively, you can request this information from payroll@smartwork.com. You will be able to submit your billable expenses with your timesheet through the SmartPortal. Please visit our guide on how to do this on the new portal by clicking here. Alternatively, you can still submit your expenses via the SmartWork expenses sheet and send it to invoicing@smartwork.com, accompanied by the relevant receipt. Please visit our step-by-step guide in the knowledge base on how to do this. If you do not currently submit a time sheet to SmartWork, your agency is probably set up as self-billing. If you want to find out, please contact us to confirm. All contracts will be available on the SmartPortal or can be requested by emailing compliance@smartwork.com. All future new contracts will be issued to you directly via Signable, which is an e-signature service. A copy of the signed document will be sent to your email inbox. Yes. The categorisation of “Bonus” will be changed to “Additional Taxable Wage”. This is more favourable when you have to provide proof of income for mortgages, loans, etc. Holiday Year Change: We’re extending the current holiday year to end on 31st December 2025, so going forward, it will run on calendar years. Please contact your business manager, and we will send you a simple online form to complete. No. If you have set up a private Pension, an agreed amount of your assignment rate is allocated to the pension, however, this will be switched to a percentage. So for example, if a £100 per day is allocated from the assignment rate of £500, this works out to be 20% of your assignment rate. Therefore, the amount you contribute will remain the same, but it will be converted into a percentage. This article explains how we calculate your pension contribution amount. If you would like a fixed weekly or monthly amount applied going forward, please contact your business manager. All contributions to your workplace pension will now be based on a percentage of your qualifying earnings. Qualifying earnings is a band of earnings we use to calculate contributions and is used by most employers. How are Contributions Calculated The figures are reviewed annually by the government. For the 2025/26 tax year, the range is £6,240 to £50,270 per year. We contribute a percentage of our workers’ gross annual earnings that fall between these figures. The first £6,240 isn’t included, so qualifying earnings can’t be more than £44,030 (£50,270 minus £6,240). For example, if a worker earns £20,000, their qualifying earnings would be £13,760. According to current legislation, we set employer contributions at 3% and employee contributions at 5% of your qualifying earnings. The table below displays the lower and upper limits of the qualifying earnings threshold for various commonly used pay periods. Here are some example calculations for a weekly and monthly pay period: Weekly: (£967 - £120) x 3% Employers = £25.41 (£967 - £120) x 5% Employees = £42.35 Monthly (factors in 4.33 weeks): (£4189 - £520) * 3% Employers = £110.07 (£4189 - £520) * 5% Employees = £183.45 Absolutely! You will be able to set either a fixed amount or a fixed percentage for your personal contributions. Yes. We’re extending the current holiday year to end on 31st December 2025, so going forward, it will run on calendar years. Your unused holidays will be brought forward and shown on your payslip. Holiday Year Change: We’re extending the current holiday year to end on 31st December 2025, so going forward, it will run on calendar years. Holiday Accrual: If you currently accrue holiday, your holiday pay will be accrued based on your full earnings. To request any accrued holiday pay to be paid for time off, please email payroll@smartwork.com as normal. Holiday Advance: If you currently have holiday pay advanced to you, it will continue to be paid to you each week or month and reflected on your payslip.Portal

Contracts

Pension

Holiday