The SmartWork Payslip Explained

This guide explains each part of your new SmartWork payslip so you can understand exactly how your pay is calculated and what each section means. As an umbrella company, SmartWork receives your assignment rate from your agency and processes all employment-related costs before paying you your net income.

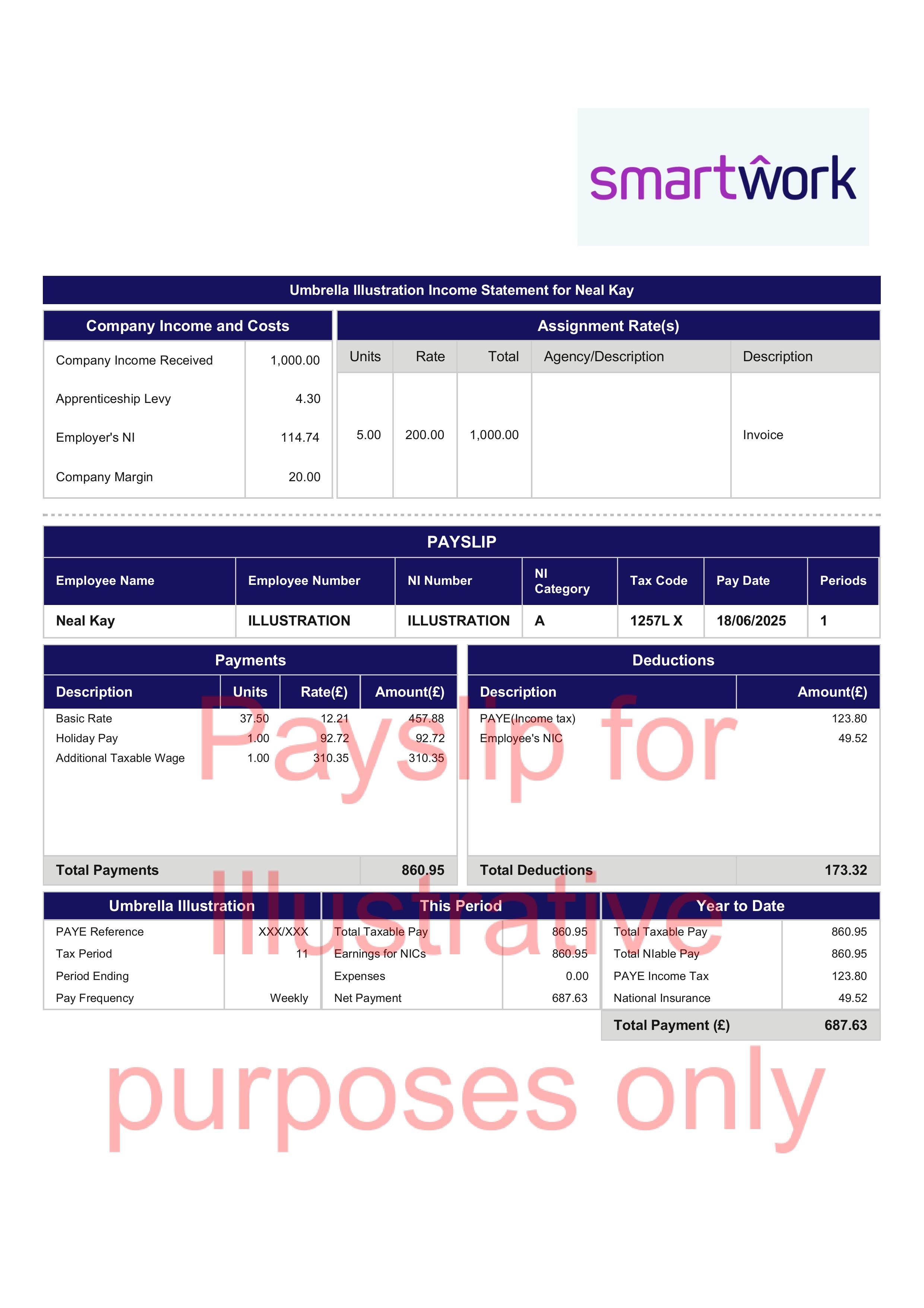

Header Information

- Employee Name / Number / NI Number: Your personal details.

- NI Category: Determines how much National Insurance you pay.

- Tax Code: Indicates how much tax-free income you’re entitled to (e.g. 1257L = £12,570 tax-free annually).

- Pay Date: The date you’re paid.

Company Income and Costs

This section shows how much SmartWork receives from your agency and the employer costs deducted from that amount before calculating your pay.

- Company Income Received: The total assignment rate SmartWork received for your work (e.g. £1,000.00).

- Apprenticeship Levy: A small percentage (0.5%) paid by the employer to support apprenticeships.

- Employer’s National Insurance: A legal obligation based on your earnings, not taken from your pay.

- Company Margin: SmartWork’s fixed margin for managing your employment.

These costs are deducted before calculating your gross pay. They do not directly reduce your take-home pay.

Assignment Rate

- Units / Rate / Total: Shows the number of hours or days worked (e.g. 5 days at £200 = £1,000).

- Agency/Description: The source of the income – usually your agency or client.

Payments Breakdown

This shows how your gross pay is calculated from the remaining funds.

- Basic Rate: Pay at the applicable National Minimum Wage (NMW) or National Living Wage (NLW), forming part of the employee’s gross salary.

- Holiday Pay: Holiday pay will be included in your weekly/monthly pay unless you request the pay to be accrued. This ensures you receive your full holiday pay entitlement.

- Additional Taxable Wage: Any pay above the NMW/NLW, based on the agreed contract rate, paid at the discretion of the company.

All these amounts are taxable income and appear in your gross earnings.

Deductions

These are your statutory employee deductions:

- PAYE (Income Tax): Based on your tax code and earnings.

- Employee’s NI: National Insurance based on your NI category and pay level.

Pension contributions are not shown in this sample because the illustration shows a deferred employee. If you’re auto-enrolled (after 90 days), this will appear as a deduction.

Umbrella Illustration

- Period: The tax week or month this payslip covers (e.g. Period 11).

- Pay Frequency: Weekly or monthly.

Summary Section

This Period

- Total Taxable Pay: The total gross earnings before deductions.

- Earnings for NICs: The portion of your pay on which NI is calculated.

- Expenses: Reimbursable business expenses (if any).

- Net Payment: The amount paid to your bank account – your take-home pay.

Year to Date Totals for:

- Taxable Pay

- NIable Pay

- PAYE Income Tax

- National Insurance

Additional Notes

This payslip is based on the 2025/26 tax year using the 1257L tax code on a week 1/month 1 basis.

- Holiday Pay is paid upfront – this holiday entitlement is designed to cover you for any time off, so you do not need to request payments for time off/ annual leave.

- Mileage Claims: Subject to supervision, direction, and control (SDC) assessment.

- Auto-Enrolment: If eligible, you will be automatically enrolled into a pension after 90 days. You’ll have the option to opt out at that point.

- Assignment Rate: The rate invoiced by SmartWork and inclusive of all employment costs (Employer NI, Apprentice Levy, holiday pay, pension, etc.).

Need Help?

Visit our Payslip FAQ page, or contact our payroll team, who are here to help:

📧 payroll@smartwork.com

📞 0800 434 6446